September 2023 update: Labor markets continue to lose steam, but no signs of an imminent recession yet

Por um escritor misterioso

Descrição

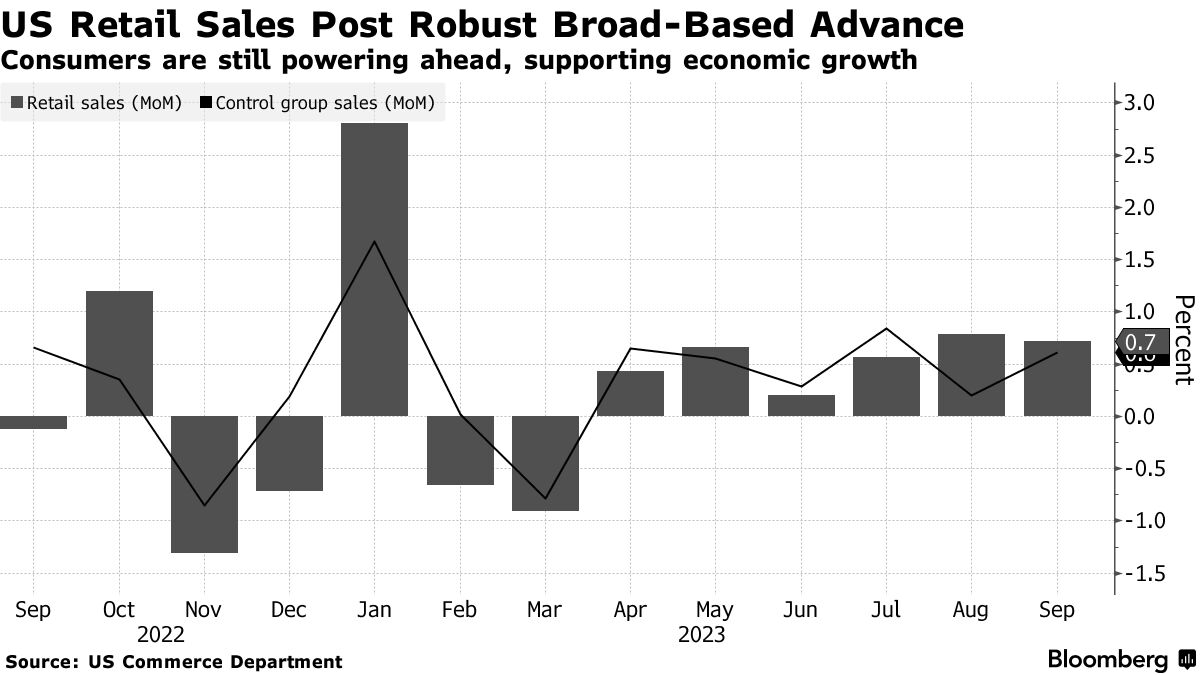

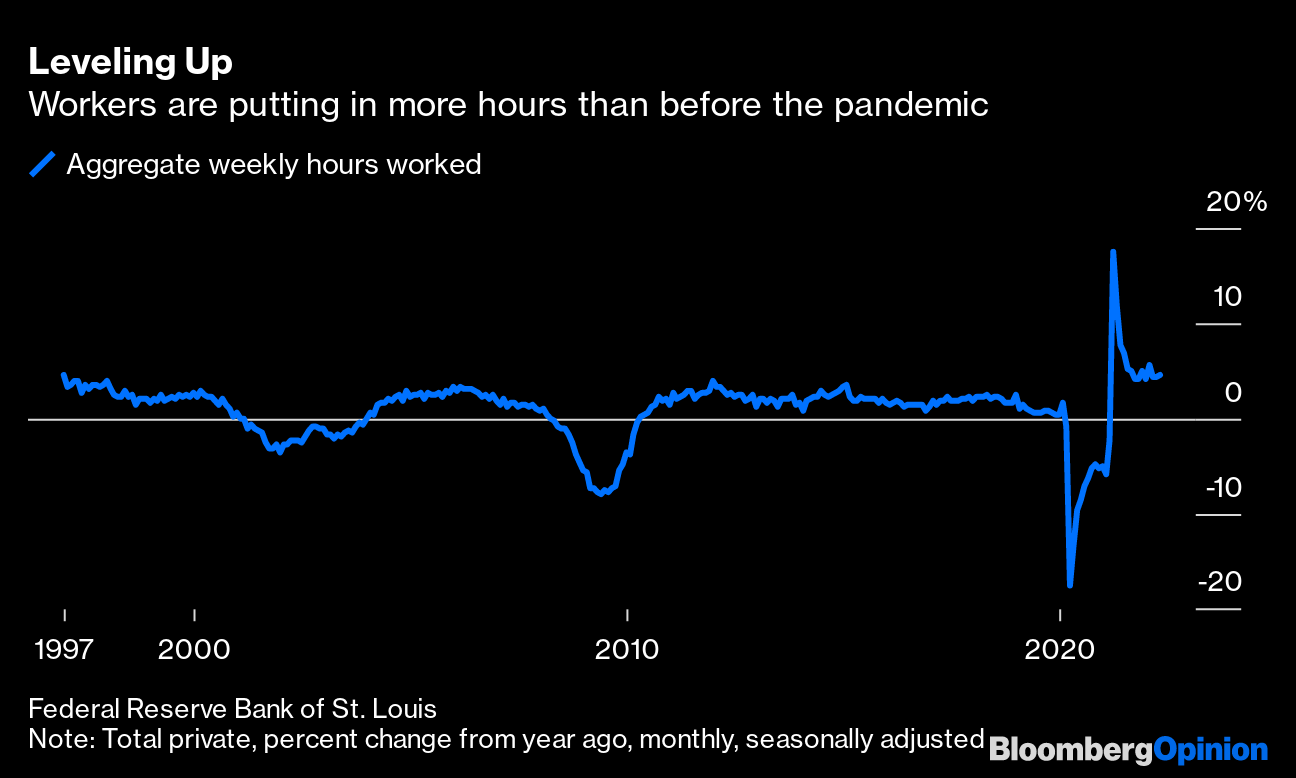

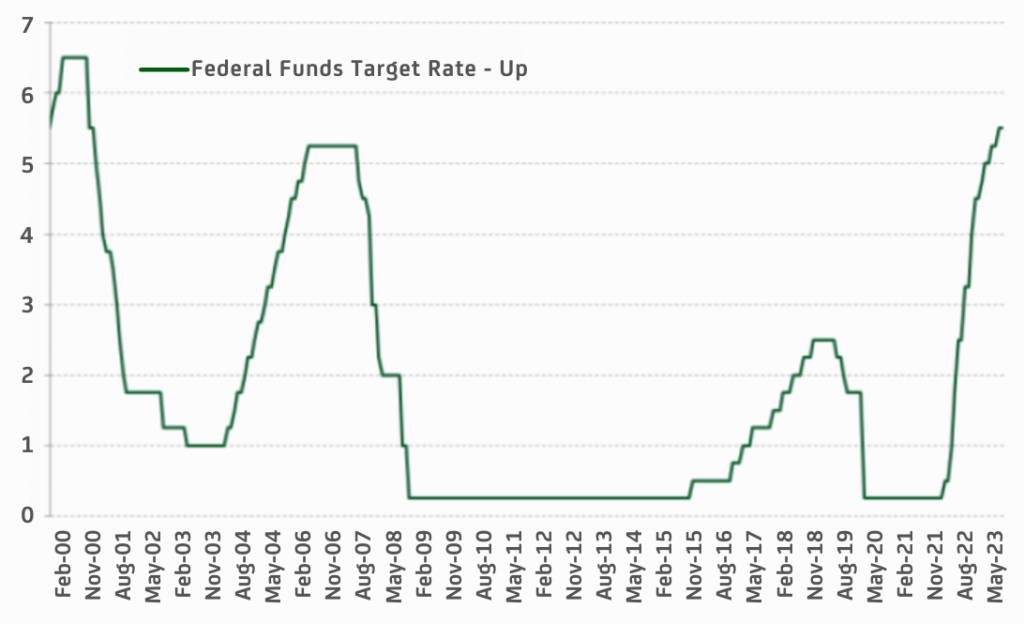

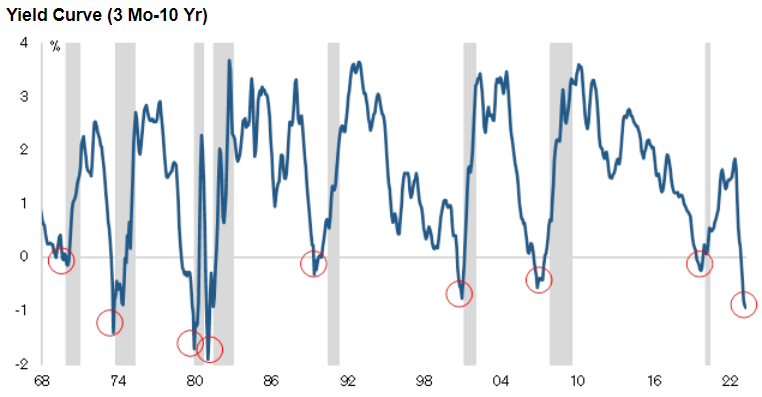

Subscribe to these updates here. Global: Overheated job markets in the US and other developed economies are rebalancing without a spike in unemployment There are growing signs that the global economic outlook has witnessed pockets of improvement, driven by steadfast consumer expenditure on services, tempered inflation, and a reduction in immediate risks within the banking sector. Despite much tighter monetary policy than a year ago, the labor market remains resilient in most countries. Nevertheless challenges persist from increased wages in a competitive job market to rising demand for services, which vary in strength across different regions. Hiring rates are continuing their year-over-year decline, albeit at a slower pace In August 2023, hiring continued its year-over-year decline across most countries. Ireland and Singapore reported the most substantial drops at -34.6% and -31.8%, respectively. Australia (-28.6%), the United Kingdom (-28.5%), and Canada (-27.8%) also experienced significant declines. Year-over-year hiring declines intensified in France (-22.2%) and Germany (-20.5%) compared to the previous two months, whereas India and Italy exhibited a slight slowdown in their decline with -22.1% and -19.7% drops, respectively. In contrast, the United Arab Emirates had a milder decrease of -13.9%. Applicants are submitting more job applications compared to last year Job search activity has surged in comparison to the previous year, yet there has been a recent deceleration in the rate of growth. In August 2023, the UK witnessed a 23% year-on-year increase in applications per applicant, while the US, France, and Singapore all experienced an increase in search intensity by 18%, 18%, and 17%, respectively. Conversely, the United Arab Emirates observed a more modest year-over-year increase of 4%, likely influenced by the summer and vacation season. US: The labor market is losing momentum, but the probability of a soft landing is increasing The US economy has shown robust growth in the first half of the year, thanks to a strong labor market which has enabled consumers to navigate the challenges posed by rising prices and interest rates, reducing the risk of a recession. Nevertheless, when compared to normal times, the medium-term horizon still carries elevated recession risks. While the likelihood of a recession may be declining, there remain elements that could potentially disrupt the path to economic recovery. These include the possibility of unforeseen inflationary surprises, vulnerabilities stemming from global economic weaknesses, and hidden or unquantified risks lurking within the financial system. On the employment front, although the labor market continues to exhibit strength, the degree of excess demand is diminishing, primarily due to companies reducing the number of job vacancies rather than resorting to increased layoffs. The decrease in job openings in the US is happening in tandem with a sustained uptick in job seekers’ search activity. Data from LinkedIn indicates that job seekers are conducting more frequent searches compared to the previous year. Specifically, the number of applications per job seeker in the US has surged by 18% year-over-year as of August 2023, suggesting a heightened level of competitiveness in today

Peak Goldilocks: Stock Markets Brace for Potential Downturn in 2023

Is the US heading for recession in 2020?

Stock market today: Live updates

US Retail Sales September 2023: Rise in Sign of Durable Consumer Demand - Bloomberg

September 2023 Update on the U.S. Economy - Astor Investment Management

Labor report shows 336,000 jobs added The Arkansas Democrat-Gazette - Arkansas' Best News Source

Market Is Set Up For A February 2020 Type Collapse (SPY)

US Labor Market Shows No Signs of an Imminent Recession - Bloomberg

Macro Update – September 2023

Biden's Dilemma: The Economic News is Great. The Polling is Terrible.

Recession: Has It Been Postponed? US Jobs Data May Tell - Bloomberg

Recession Outlook 2023: a Good Jobs Market Has Saved Us so Far

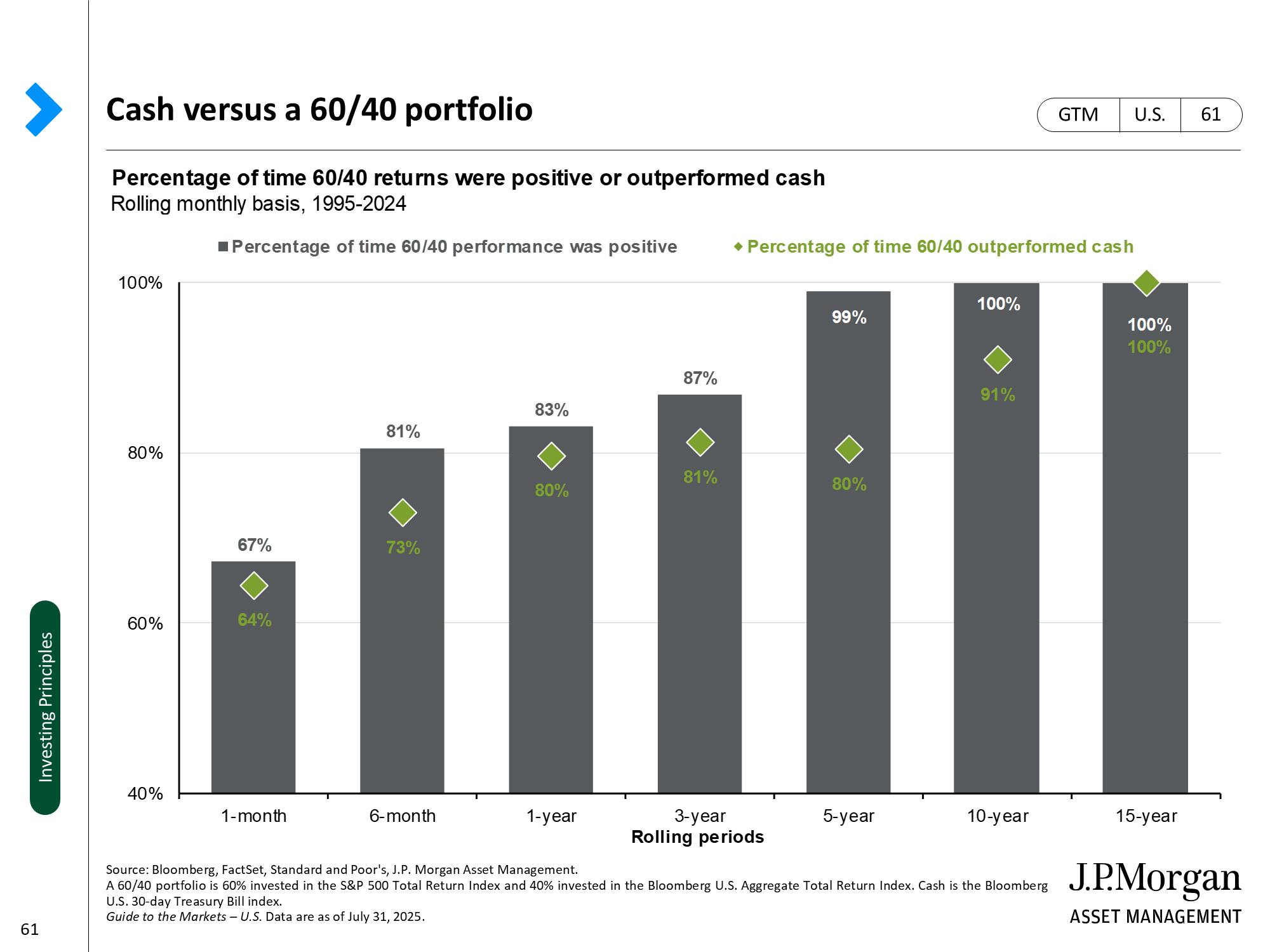

Economic & Market Update J.P. Morgan Asset Management

US weekly jobless claims fall; tight labor market underpinning economy

3rd Quarter Economic Outlook: Inflation, Recession, & Future

de

por adulto (o preço varia de acordo com o tamanho do grupo)